Managementgoeroes.nl

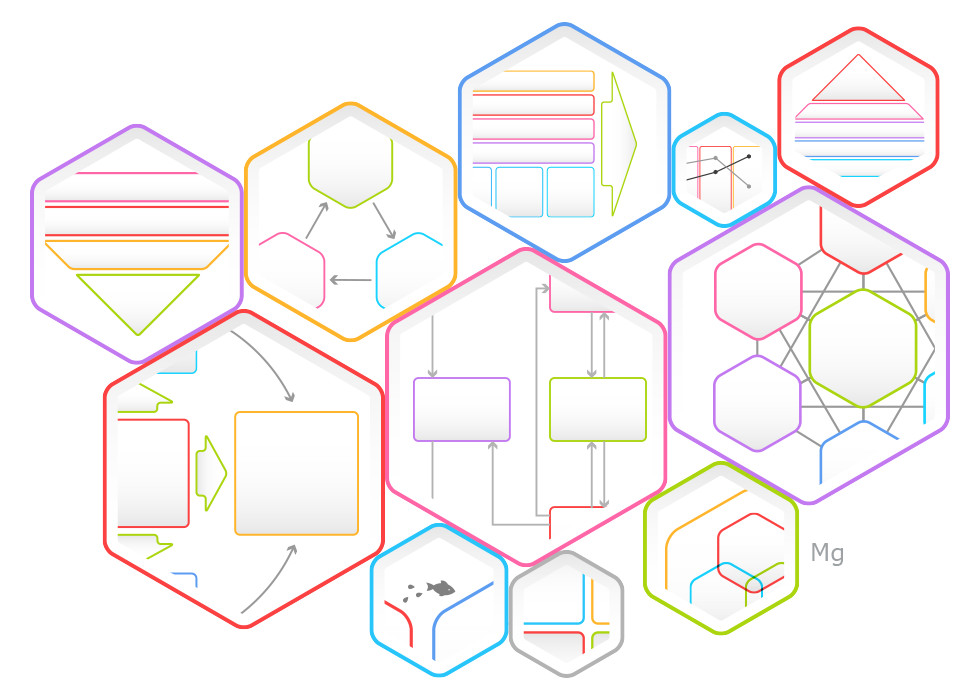

Managementgoeroes.nl is opgericht om studenten en professionals te helpen bij hun rapporten, presentaties en scripties. De bekendste management- en marketingmodellen zijn tot in detail op deze website uitgewerkt. Per model geven we vele praktijkvoorbeelden, afbeeldingen en definities. Doe er vooral je voordeel mee!

Je bent vrij de afbeeldingen en informatie van deze site te gebruiken, mits je netjes een bronvermelding met link naar deze website gebruikt. Bij je scriptie hoef je uiteraard niet te linken 🙂

Na een aantal omwentelingen is managementgoeroes.nl vanaf maart 2024 in een nieuw jasje gestoken. Geniet er van!!

Bekijk alle managmentmodellen:

- 4G feedback methode

- 7 Habits Steven Covey

- 7s Model McKinsey

- Ansoff Matrix

- Balanced scorecard

- Blue ocean strategy

- Build measure cycle lean startup

- Communicatiemodel van Lasswell

- Communicatiekruispunt van Ruler

- Circular flow of income

- DESTEP analyse

- Gantt chart

- Generic strategies Michael Porter

- Lean startup methode Eric Ries

- Marketingmix (4 P’s)

- Motivatie hygiene theorie Herzberg

- Piramide van Maslow

- Value Chain Michael Porter

- Vijf krachten model Porter

- Waardeposities Treacy & Wiersema

Managementbegrippen

- Accountable marketing

- Affiliate marketing

- Affiliaten netwerk

- Aftersales

- Agile

- App-marketing

- B2B

- B2B-marketing

- B2C

- Bartering

- Basic-marketing

- Bouncerate

- Brainstorm

- Brand-equity

- Cash-cow

- Citation building

- Commodities

- Conversie

- CPC

- CRM

- CRM-systeem

- Cross selling

- CTR

- Demand generation

- Differentiatie

- Diversificatie

- Dog

- Early-adopters

- eCPC

- Gamification

- Google AdWords

- Hefboomeffect (leverage)

- HRM

- Intrapreneur

- Klantretentie

- KPI

- Landingspagina

- Lead generation

- Market fit

- Marketing automation

- Marktpenetratie

- Minimum viable product

- Mond-tot-mondreclame

- Nulmeting

- Opportunity-costs

- Partnership marketing

- Premium pricing

- Prince2 methode

- Proactieve marketing

- Product-evangelist

- Projectmanagement

- Propositie

- Pull-marketing

- Push-marketing

- Question mark

- Quick wins

- Reactieve marketing

- Scrum

- Sociaal culturele factoren

- Stakeholders

- Star

- The internet of things

- Totale marktpotentieel

- USP

- Value-innovation

- Watervalmethode

- Wet van de remmende voorsprong